IntroLend the Consumer Experience

The customer-centric mortgage platform that’s all about you

IntroLend is the customer-centric mortgage platform that’s all about you.

Consumers get instant pre-approval and FAST closing – plus a dedicated loan advisor – for the ultimate mortgage journey. What’s more, IntroLend also offers a free credit and identity protection suite. This means prospective borrowers can quickly obtain, understand and begin optimizing their credit — right on the IntroLend site — thus enhancing their ability to qualify for a great mortgage.

Credit Manager

Brings one’s credit report to life, with personalized tips to improve your score.

Debt Optimizer

Places all credit card, auto, home, student & personal loans on one dashboard. Includes helpful tips to lower monthly payments.

Identity Protector

Safeguards identity & finances by monitoring credit accounts and personal data — sending alerts by text and email.

Home Purchaser

A single-source for the entire home-buying process. Consumers can find the best realtor, property & mortgage all in one place.

Mortgage Refinancer

Places all credit card, auto, home, student & personal loans on one dashboard. Includes helpful tips to lower monthly payments.

How IntroLend Works

Within the broader Avenu model

RESPA-compliant IntroLend Chapter is formed inside Real Estate office.

Agents attract Clients via legacy channels and IntroLend platform.

Agent texts Client “Fast Track” invite to IntroLend’s online mortgage application.

Agent has pre-loaded familiar lenders onto IntroLend platform; sends suggested bidders to Client (from both outside lenders and IntroLend)

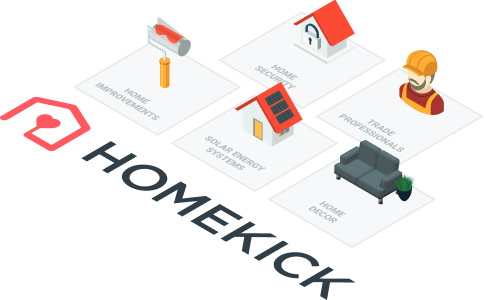

IntroLend Finance Manager helps Client — from loan application & pulling docs, to fast pre-approval, to getting current home in shape to sell with HomeKick.

Client selects winning mortgage quote; proceeds to home closing.

Finance Manager provides financial check- up for Client on IntroLend. Agent loads their preferred home decor, security, solar & trade pros onto Client’s HK w/$50 credit.

Client gets superior personal finance & home offerings over time; becomes “Infinite Customer”

RESPA-compliant revenues flow to IntroLend Chapter from Mortgage & downstream events